- Advice You Can Trust

Professional Tax Preparation Services

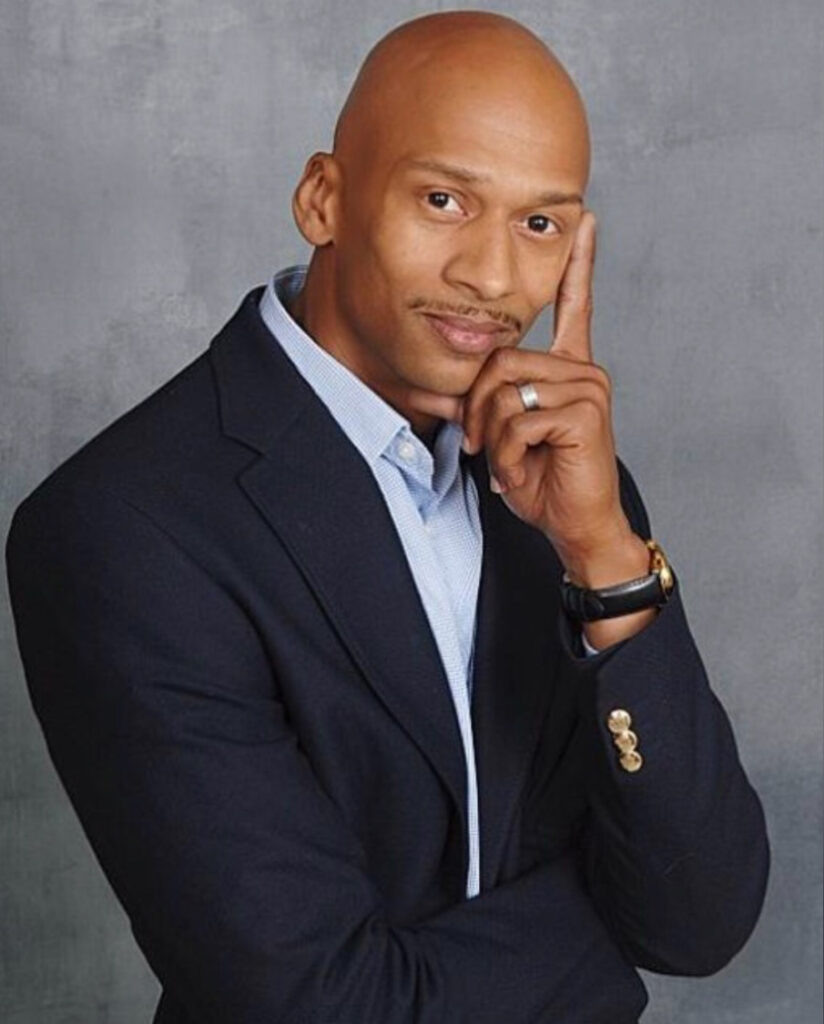

Jason Jennings

Strategic Tax

Planning Services

Maximize savings, minimize liabilities: Strategic Tax Planning Services ensure financial efficiency, compliance, and optimized returns.

Fed & State

Electronic Filing

Efficiently file taxes! Fed & State Electronic Filing simplifies the process, ensuring accuracy and timely submissions.

Tax Preparation for Individuals & Businesses

Tax Preparation for Individuals & Businesses offers expert guidance, ensuring compliance and maximizing deductions.

- About Us

A Legacy of Excellence in Tax Preparation

Jason Jennings is a seasoned income tax preparer with an extensive track record spanning two decades.

With a wealth of experience in the field, Jason has honed his expertise in navigating the complexities of income tax preparation for individuals and businesses alike. His commitment to accuracy, attention to detail, and dedication to client satisfaction have earned him a reputation as a trusted professional in the industry.

Jason’s comprehensive understanding of tax laws and regulations allows him to provide tailored solutions to meet each client’s unique needs and maximize their financial outcomes. As a reliable partner during tax season and beyond, Jason Jennings is committed to delivering exceptional service and ensuring peace of mind for his clients year after year

- Error-Free Returns

Attention: IRS Audit Rates

are on the Rise

Rest assured, our tax return services include thorough checks for mathematical accuracy and identification of IRS-flagged errors, reducing the chances of IRS contact.

Here are strategies to optimize your payroll withholding, allowing you to enjoy increased income throughout the year instead of lending it to the government and awaiting its return at tax time.

Electronic filing service for faster refunds, simplifying the tax process and ensuring swift receipt of your funds, enhancing convenience and efficiency.

Explore common deductions for the upcoming year and practical tips to reduce future tax liability, maximizing tax savings and enhancing overall financial planning strategies for greater financial well-being.

- Our Philosphy

Fostering Trust Through Tax Expertise

At NJ Tax Pros, we’re committed to empowering clients with personalized tax expertise, prioritizing excellence, integrity, and meticulous attention to detail. Our dedicated team in New Jersey ensures clarity, confidence, and peace of mind for individuals and businesses by staying informed about the latest tax laws and regulations.

We tailor solutions to maximize refunds, minimize liabilities, and optimize financial outcomes. With a focus on transparency, reliability, and client satisfaction, we’re your trusted partner for all tax preparation needs.

- Personalized Service: We believe in catering to the unique needs of each client, offering customized solutions and attentive support throughout their tax journey.

- Transparency and Integrity: We uphold the highest standards of transparency and integrity in all our interactions, ensuring clients feel confident and informed every step of the way.

- Continuous Learning and Improvement:We are dedicated to staying ahead of the curve by continuously updating our knowledge of tax laws and regulations, enabling us to provide the most effective and up-to-date solutions for our clients.